With a worryingly low number of adults in the UK making a will, it’s likely they’re not only worried about the money they’re leaving behind, but the money they’ll pay out.

So, how much does making a will cost?

It depends on the complexity of your estate, whether you have stocks and shares if you need a trust, and many other factors. In many cases, a simple will can cost a couple of hundred pounds, but the more complicated your finances are, the more work your solicitor will have to do to make sure your will is best for your inheritors.

How much does will writing cost?

- Simple wills – simple wills where you do not have any complicated assets or requests can cost around £150. These can be cheaper if you do it yourself, or use a will writing service, but it’s always important to check the will is legally valid and all the correct paperwork has been filled out. If you are under 50, don’t have a particularly large estate or any children from previous marriages, a simple will may be your best option.

- Complex wills – complex wills are a good option when you have a fairly large estate, want to leave money into a trust, or you own a business. It means your solicitor may have to put in place rules about delaying inheritance money for minors or deal with inheritance tax issues. A complex will can cost around £200-£400.

- Joint wills – joint wills are treated as a single document. They are made together by a married couple and are designed to ensure that the remaining spouse inherits the sum of the deceased’s assets. There are legal implications with writing a joint will, in that it cannot be amended when one partner has died. Which becomes difficult if the surviving partner remarries and wants to leave something to their new spouse. A joint will costs around £200-£600.

- Mirror wills – mirror wills are for married or civil partnership couples who have the similar outcomes in mind for their wills. The wills are drafted to be the same, in that if one partner dies, the money is transferred to the other partner. You can leave allowances for children, name guardians and executors and do everything you normally would in your will. You can also include your own specifications to the will, leaving certain personal items or assets to particular people. The reason mirror wills are favoured is that they allow inheritance tax allowance to be passed on to the surviving partner, so when the estate was eventually passed on to any children inheritance tax would be minimal. Mirror wills cost an average of £250 for both wills.

Do you need a solicitor for will writing?

It is easy to think of creating your own will if you want to save money, but the more complex your estate is, the more likely you are to make mistakes.

It’s not only a case of identifying your assets, but if you are leaving money to children, or a partner, or you have specific stocks, shares or property that will need to go through probate, then having a qualified solicitor or professional will-writer who is experienced in writing wills is probably the best option.

There are some other great reasons to use a solicitor or will writer.

- Clarity – you can ensure you get exactly what you want from your will.

- Less likely to be contested – if your will might be contested by family members or due to mental health issues, your solicitor can ensure it is legally binding and fully enforceable.

- Fewer errors – trying to fill out a will yourself may leave you open to errors that could be exploited or may simply be ignored and carried out according to law.

- Legally binding – there are certain factors that make a will legally binding, and your solicitor will make sure these are carried out.

- Complexity – when it comes to trusts, large assets and complex arrangements, it is always best to let a solicitor take control of writing your will. Leaving your loved ones in a complicated situation after your death is not ideal.

For more information, see our guide, 'Writing your will: Should you do it yourself, use a solicitor or a will-writing service?'

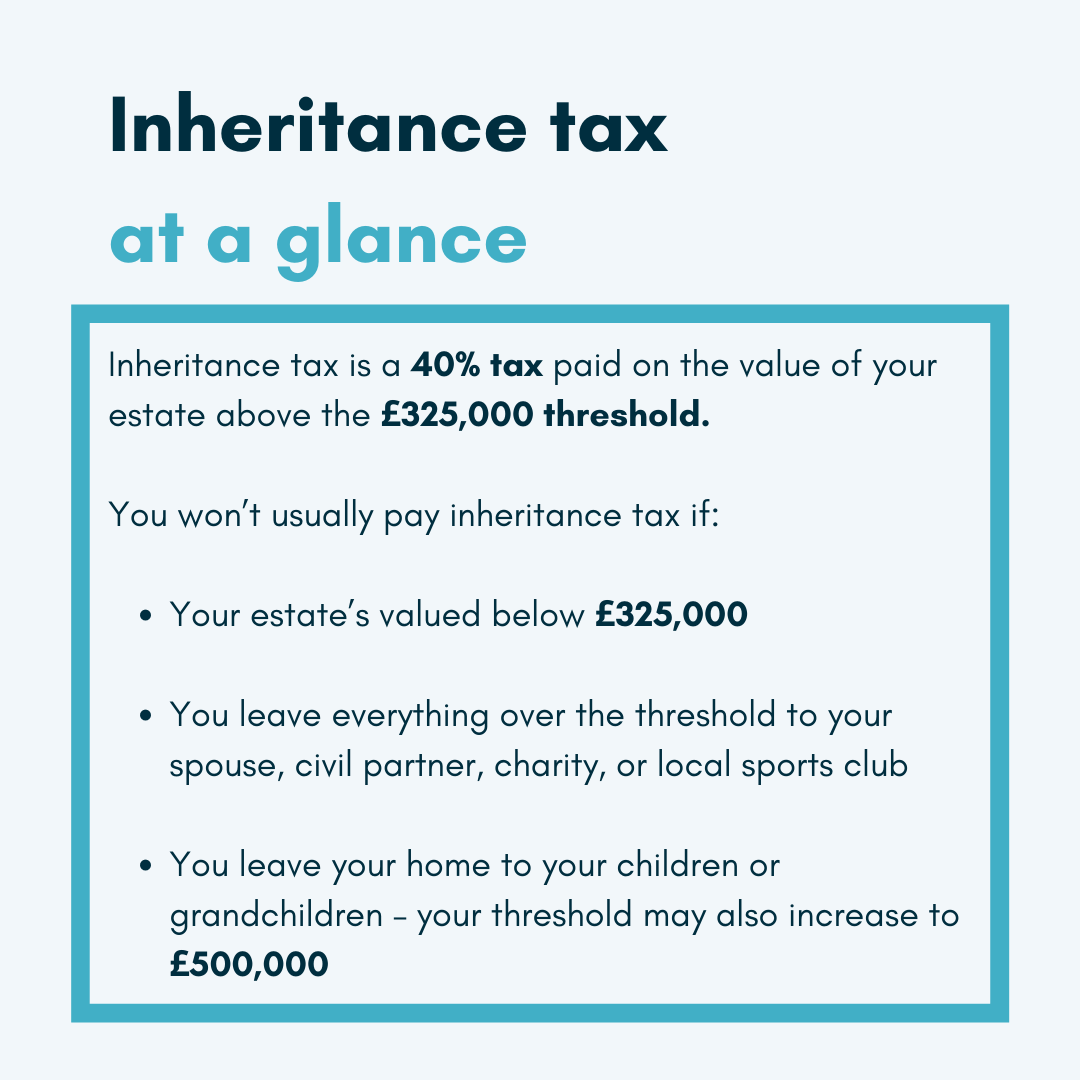

What about inheritance tax?

One of the main reasons to use a solicitor when writing a will is to pre-empt inheritance tax costs. For estates worth over £325,000, you will pay 40% in inheritance tax. If you do not leave a will, the inheritance tax is likely to be higher due to the rules of intestacy.

However, using a solicitor to write your will means they will be able to advise you on how much to leave to your spouse, whether to set up trusts or charitable donations, and other elements that will ensure your inheritors do not lose a large amount of your estate to inheritance tax.

With will writing, as well as many other legal services, it is easy to try to look for the cheapest option, but a will is about safeguarding your future, and it is best entrusted to a professional.

Whether you’re concerned about leaving a trust for your children, understanding how your property will feature in inheritance tax or don’t know how your business will feature in your will, the best thing you can do is discuss it with a professional and experienced solicitor.

The money you invest now in writing a will can serve your family well in the future, and protect your legacy.