Perhaps you’ve agreed to help share out the belongings and money of someone close to you who’s passed away. You’ll usually need to obtain a grant of representation. A grant of representation is a certificate that gives you the right to administer an estate.

This is what people usually mean when they discuss a grant of probate. We’ll guide you through everything you need to know about grants of representation and how to get one.

What is a grant of representation?

A grant of representation is a certificate that says someone has the legal right to handle the deceased's estate. This might be you, or an executor of a will. You might then ask, ‘is a grant of representation the same as a grant of probate?’

The answer is yes – and no.

A grant of probate is one type of grant of representation. This is in the same way a Fiesta is a type of Ford or an apple is a kind of fruit. The same goes for grants of representation and probate – not all grants of representation are grants of probate.

There are, in fact, two forms of grant of representation:

- A grant of probate

A grant of probate is applied for by an executor of a will, giving them the legal right to manage the estate. This allows access to deal with the deceased’s money and share their property in accordance with the will.

- A grant of letters of administration

If the deceased left no will then a family member should apply to obtain a grant of letters of administration. This is known as dying intestate. Letters of administration let you administer the estate and manage any assets.

In Scotland, the process of applying for a grant of representation is known as ‘confirmation.’ It differs slightly to England and Wales. If the person who died lived north of the border, please read our short guide on how to apply for probate in Scotland. The rest of this guide deals with the process in England and Wales.

When is a grant of representation not needed?

A grant of representation is generally not needed when administrating a small estate. Certain assets, up to £5,000, can usually be shared out without the need to go through the legal process of probate.

However, different banks and building societies have different rules and conditions for probate. Some may not require a grant of probate or letters of administration, even if the deceased’s account holds, say, £30,000. On the other hand, some may still ask for a grant of probate or letters of administration. This is even if the total value is lower than the £5,000 threshold.

If your dealings with the estate include property and money, it almost certainly requires a grant of representation.

How to obtain a grant of representation

The steps for applying for a grant of probate and a grant of letters of administration are similar. However, there are certain different requirements for each.

Do I need a solicitor to get a grant of probate?

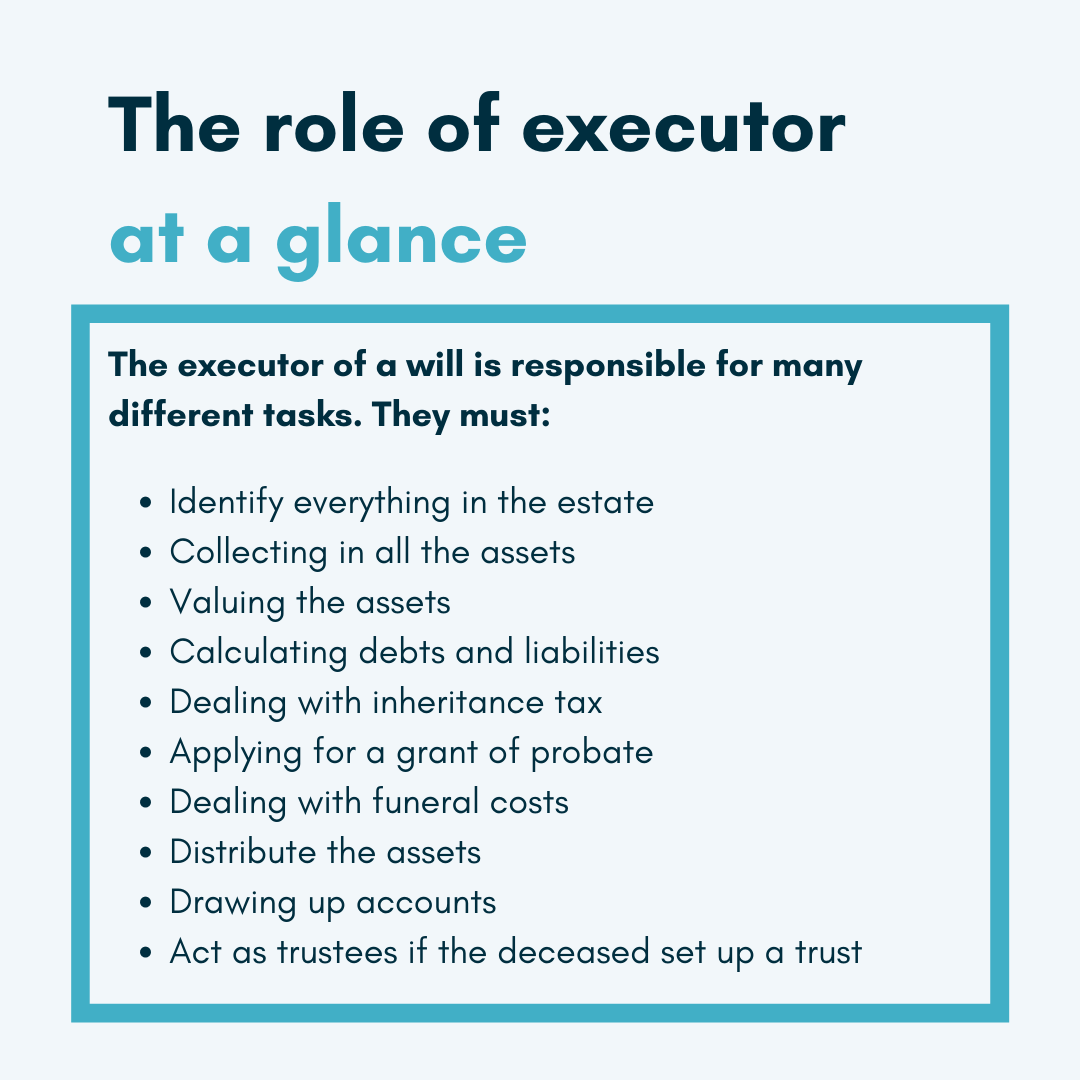

As an executor or administrator of a will, obtaining a grant of probate is relatively straightforward. But undertaking the role may not be quite so simple.

If you’re in possession of the relevant documents, obtaining a grant of probate can be done online through the government website. Important documents you'll need include a death certificate and the original will that names you executor. You can also apply via post using the government’s PA1P form. If you don’t have the will, you need to fill in a ‘lost will’ form.

Remember: it’s your responsibility as the executor or administrator to make sure there are no mistakes. You may find it helpful to talk to a qualified probate solicitor who can guide you through the process and requirements.

How do you acquire a grant of probate?

To acquire a grant of probate, there are 5 major steps.

1. Register the death

Prior to applying for probate, it's important to register the death. Within 5 days of the death taking place, you must contact a registry office.

2. Determine the value of the estate

In valuing the estate, you'll be in a better position to make choices around inheritance tax. You'll also have a better understanding of the deceased's assets.

3. Inheritance Tax

Estates valued over £325,000 will incur inheritance taxation fees. You can pay this using a IHT400 form.

Even if the value of the estate is below the £325,000 mark, you'll need to fill out an inheritance tax form.

4. Probate Application

From here, you are able to complete a probate application (PA4P). This will involve a large amount of form filling and the help of a solicitor would support you greatly.

5. Probate fees

If the estate is valued at £5,000 or more, probate applications will cost you £215. If it's valued below £5,000, it is free.

Obtaining a grant of letters of administration

The process of applying for letters of administration is similar to applying for a grant of probate. You can use the Apply for Probate gov.uk website.

To use this online service, there are some slightly different requirements:

- The deceased needs to have permanently lived in England or Wales, and have have a date of death after October 1st 2014

- You need to possess an inheritance tax form

- You must be the spouse, civil partner, or child of the deceased (and aged over 18, too)

- Your letters of administration application must be an individual application. You can’t make a joint application alongside someone else in your family.

Should you fail to meet any of the conditions above, you’ll need to obtain the grant by printing and filling out a PA1A form available from gov.uk.

How long does it take to get grant of probate or letters of administration?

The time it takes for probate to be granted varies. The government has a target of ten days for processing probate applications, but this is a goal, not a rule. Expect the process to last, on average, between a month and three months – but prepare for it to take longer.

It really all depends on the circumstances. It’s not usually affected by whether you have a will unless there are issues with the will, or it’s being contested.

Other factors can speed up or slow down the process. Perhaps there's a large number of beneficiaries, unprofessional executors, or hard-to-value assets.

A small or simple estate with no inheritance tax due could be wrapped up in approximately a month. This is provided that you possess all documents and properly complete all forms.

With more complicated estates, it can take much longer to obtain a grant of probate or letters of administration.

What’s the cost of obtaining a grant of probate or letters of administration?

The application fees for grants of probate and letters of administration are the same:

- As mentioned before, if the value of the estate is less than £5,000, it’s free

- If the estate exceeds £5,000, then the cost is £215 for individuals or £155 for solicitors

- You may also need to pay for additional copies of the grant. These cost £1.50 per copy.

These figures don’t include any additional solicitors’ fees. We can help put you in touch with up to four legal professionals to save you money and ease the process for you.

For further information, see our short guide, ‘How much does probate cost?’

Is a grant of probate difficult?

A grant of probate can become complicated, especially if the deceased has left behind a lot of assets. Settling debts and estate administration can create stress for executors and family members, on top of dealing with grief.

The best way to manage the difficulties of grants of probate is by seeking aid from a solicitor. They'll be equipped to simplify and streamline the process with you.

What happens after probate is granted?

Once probate has been granted, as executor or estate administrator, you can begin contacting banks and organisations to legally obtain the deceased’s assets. You’ll also need to settle any debts and pay any tax due on the estate from the deceased’s funds.

Once these steps are complete, you can then begin managing the wishes of the deceased as expressed in their will. If no will exists, the deceased’s assets will need to be shared out on the basis of the rules of intestacy. Some assistance with these rules can be found at ‘Intestacy - who inherits if someone dies without a will?’. But it is strongly recommended that you obtain advice from a solicitor specialising in this area, as the rules can be complex.