Is grant of representation the same as probate?

A grant of representation includes a grant of probate and grants of letters of administration. The only difference between these two is that the term probate is used when there is a will, and letters of administration when there is not. Often people use the term ‘probate’ to cover the whole process, or 'confirmation' in Scotland.

You can learn more in our guide, What is a grant of probate and how do you obtain one?

How long does it take for a grant of representation?

How long a grant of representation takes is dependent on individual circumstances. For instance, if there are complications with the case or disputes yet to be resolved, it can take longer than expected. On average, it can take up to 16 weeks to obtain a grant of representation.

Who can have a grant of representation?

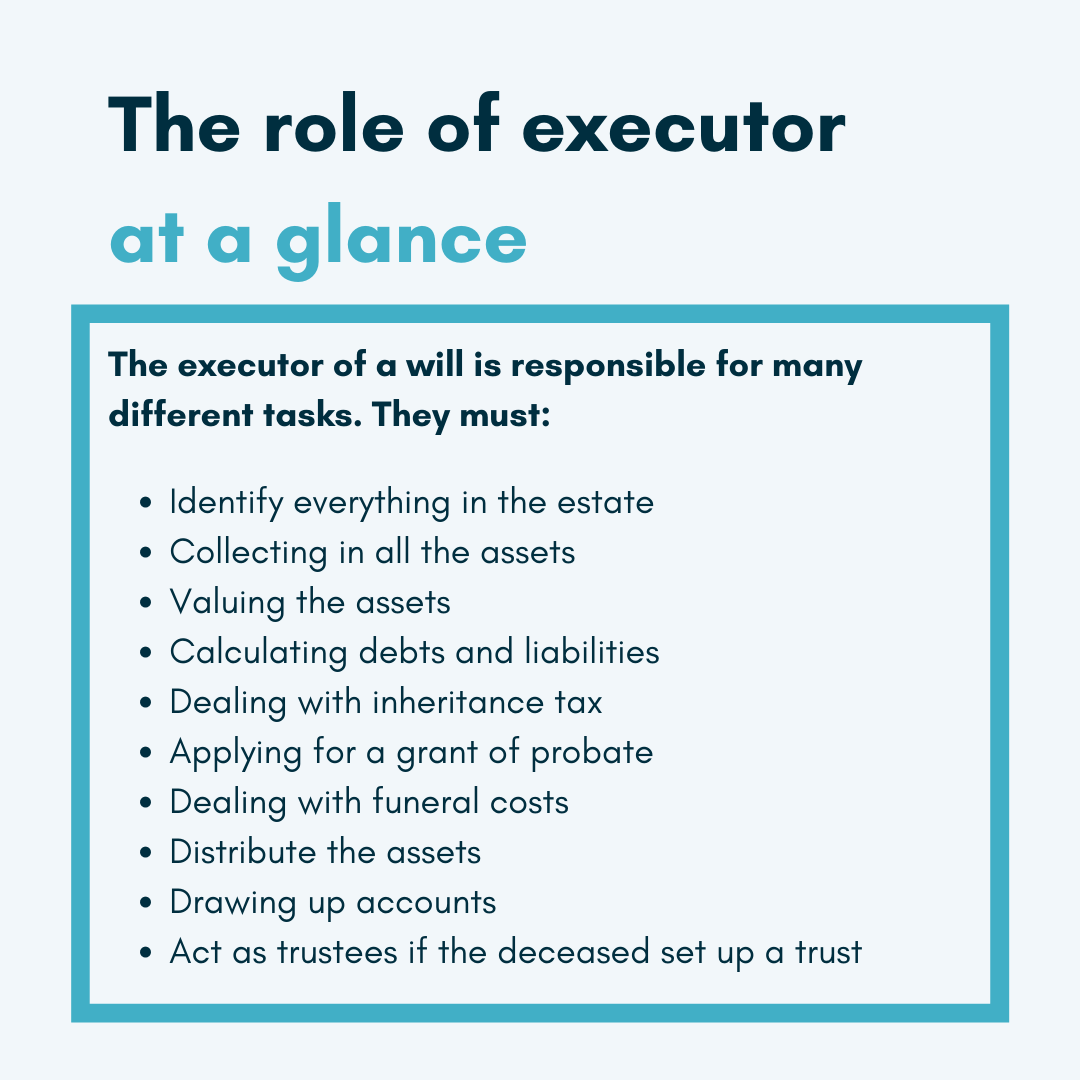

The will usually states who the executor of the will is. If there is no will or no executor is stated, the next of kin can apply for a grant of representation. Perhaps you have been named an executor in the will. If you are not able or do not want to be responsible for administering the estate, you can pass this over to someone else.

If you have no one else, you can fill out paperwork renouncing your responsibility as executor. This will then allow someone else to apply for a grant of representation.

If there is a will you can apply for probate if the total estate has been left to you, or as above, the named executor is not able to fulfill their duties.

Who has priority to apply for a grant of representation?

There is an order when it comes to next of kin applying for probate:

First priority is a surviving spouse in either marriage or civil partnership, followed by their children. This is then followed by grandchildren, then parents, then siblings, nieces or nephews and then the next closest relative.

Unmarried couples or those not in a civil partnership cannot be executors unless they have been named in the will.

How do I apply for a grant of representation?

You can obtain a grant of representation on your own, or through a solicitor. If Inheritance Tax is owed, this will have to be paid to the HMRC before the grant of representation can be enacted. The HMRC will supply a receipt that can be given to the probate office. If you managed to fill out a short form for inheritance tax, you can simply supply this with your application for the grant of representation.

If you are applying through a solicitor, you will be required to swear an oath that explains your relationship to the deceased, and the value of the estate. This is usually done in the solicitor’s office. This will be put on file with the applications, the will and any inheritance tax forms, and if there are no issues, a grant of representation will be issued within a couple of weeks.

If you are applying without a solicitor, you will have to fill out a PA1 form, as well as providing the will, inheritance tax forms and any other supporting documents, and will then be invited to an interview, at a probate office, where you will swear an oath. If there are no issues, a grant of representation will be sent in a few weeks.

What forms and paperwork do I need?

A PA1 form is needed to assess the estate and its value. You may also need inheritance tax paperwork. If you are applying in Scotland, you will need to fill out form C1 for ‘confirmation’, which can be found online.

When don’t you need a grant of representation?

Usually, a grant of representation is not needed if the value left by the deceased is less than £5000 or their possessions were co-owned. Also, if the estate is insolvent, and will be used to cover debts or costs. Grants of representation are more necessary if the deceased owned a lot of financial assets. They may have had stocks and shares, property or land, insurance policies or anything to the value of more than £5000.

What is the rule of intestacy?

The rule of intestacy is concerned with how an estate is shared if there is no will. So, couples in marriages or civil partnerships can inherit from their deceased partner, along with next of kin.

The rule of intestacy states that the estate will transfer to the partner of the deceased. This is as long as they are married or in a civil partnership. And if the estate is valued at over £250,000 the partner will receive the first £250,000, then half of the remaining amount. The other half may be given to children, or grandchildren, depending on who the next of kin is.

If the estate is valued at less than £250,000, this will solely be inherited by the surviving partner.

Where do I get the probate application form?

You can get the PA1 application form either through your solicitor or from a probate office or online at gov.uk. You will also need to fill out the inheritance tax form, depending on the size of the estate and how much is owed.

How much does does a grant of representation cost?

The cost of attaining a grant of representation depends on how complicated the dealings with the estate are, as well as how many copies you may need.

You can attain a grant of representation yourself for £275. But if there is an inheritance tax, the estate is still earning money, or there are complications with the will and those who should inherit, it may be worth hiring a specialist solicitor. They'll be able to streamline the process and offer legal advice on how best to proceed.

You can compare the costs of probate solicitors here on The Law Superstore, to get a clear idea of the cost.

What happens after a grant of representation?

This will allow you to start dealing with the deceased’s estate. You will be able to access all financial documents belonging to the person and send a copy of the death certificate to banks and building societies. You can also ensure any payments are frozen from those accounts.

You will need to work out if the deceased owed, or was owed, any money. You'll then need to prepare an inventory of everything included in the estate of the person who died. It is also wise to set up an bank account solely for the estate when money is released, or property is sold.

You will also be responsible for ensuring solicitors’ fees and any outstanding bills are paid. You will also need to contact the tax office, and possibly the department for work and pensions to alert them to the death.

Grant of representation in Scotland

Dealing with probate in Scotland is slightly different than in England and Wales as this will go through Scottish courts. As such a grant of representation is called a ‘confirmation’. In order to receive this, an inventory must be submitted and must include either money or property in Scotland.

Scottish probate law also works under the law of intestacy. So, if there is no will, the same order of inheritance applies. However, there is different paperwork depending on the size of the estate, and different costs for receiving confirmation. So, do discuss these with your solicitor.