Mapping out Your Estate and Assets

You don’t need a portfolio of property and a vault full of assets to make a will. If you have anything you wish to gift to friends and family, you should consider making one. So, even if your grandfather’s old watch isn’t worth that much, it carries sentimental value, and you may want to pass it on.Before you write your will, make a list of what you own – property, cars, savings, businesses you own, personal possessions, everything. Be sure to include the values of each. This will make it easier to share them out among your beneficiaries and resolve any financial issues, such as tax, that may arise.

Listing your beneficiaries (and what to gift them)

Who’s going to get what? Beneficiaries are those who will benefit from your will, whether it’s a sum of money or your favourite salt-shaker.Once you have a good idea of what your assets are, you can begin working out who will inherit your possessions. Again, it’s wise to create a list of beneficiaries first, then decide how they’ll benefit. You don’t want to spend time dividing your assets, only to realise you’ve left your beloved Aunt Margaret off the list.

Beyond friends and family, you might also want to include charities and other organisations in your will.

Think of this as a dress rehearsal – nothing is settled and finalised until it’s in your will.

Choosing your executors, trustees, guardians, and witnesses

Responsibility is the key to choosing an executor, trustee, guardian, or witness.The executor is the person you decide to handle your estate after you die. There’s a lot of responsibility, not to mention paperwork, involved and the slightest misstep can throw the whole endeavour into turmoil, so it’s important to choose the right person for the job. You have appointed up to 4 executors, but be careful when choosing them to avoid any disagreements when managing your estate.

If you’re in a relationship, it’s common practice to appoint your partner as the executor. Any children you have over the age of 18 are also good choices – not least because, as they’re younger they’ll likely live longer.

It’s generally considered best practice to appoint two executors; a primary and a back-up who stands ready to take over should your first choice be unable to perform the role.

If your will includes a trust, you may also want to specify a trustee who will manage the estate for a named beneficiary. This can be the same person as your executor, or another responsible adult.

If you have children under the age of 18, you can also name a guardian who will care for your kids in the event of your death. That’s not a decision to be taken lightly.

To ensure your will is valid, you need two witnesses who must sign the will (and watch you sign it). They won't need to know the contents of your will; they only need to know that you made your will voluntarily and you understand the implications.

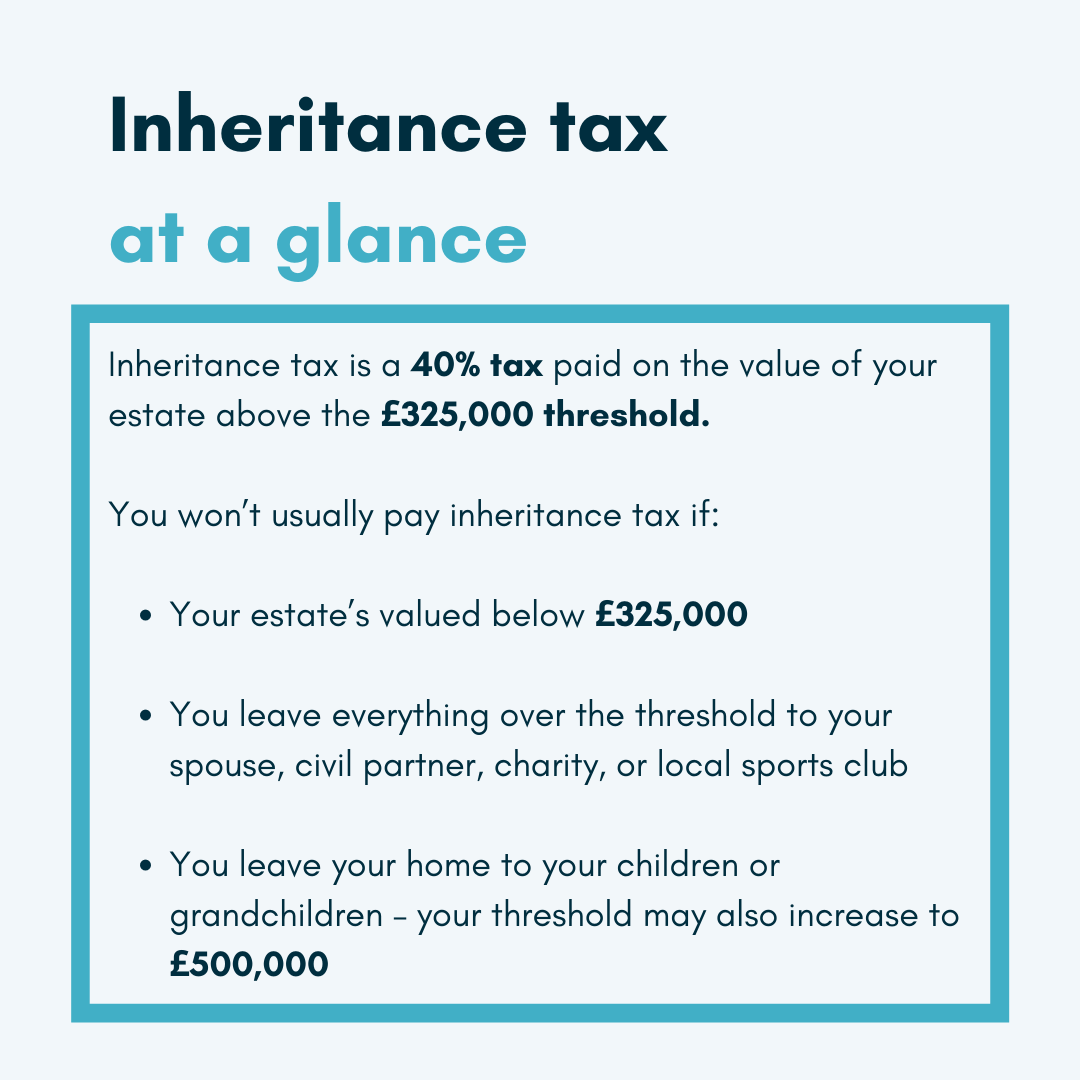

Work out your inheritance tax

If the value of your estate – that’s all your property, money, and possessions – is under £325,000, you won’t need to worry about inheritance tax.If it’s above this, then you’ll need to plan accordingly. It’s a good idea to keep this in mind when preparing to make a will.

Inheritance tax currently sits at 40% of anything above the £325,000 threshold. So, if your estate is worth £400,000, you’ll pay £30,000 in inheritance tax (or 40% of £75,000).

It’s possible to avoid paying inheritance tax if you leave your estate to your spouse or civil partner. You can also raise the £325,000 inheritance tax threshold to £500,000 when leaving your home to your children or grandchildren.

Sorting your online accounts

Most people associate wills with dry, sensible topics like money, but these days, we all live online to some degree – be it social network accounts, shopping sites, your own website, or emails.Some sites, like Facebook, already have a process in place for choosing a ‘legacy contact’ who looks after your account after it’s been memorialised. For others, you can specify who will protect your ‘digital legacy’. When you’re getting ready to write your will, you should have a quick think about who you’d like to access and manage these after you’ve passed away.

Writing your last wishes

Before making a will, seriously consider what sort of funeral you’d like: do you want to be cremated, buried? You don’t need to stipulate your funeral wishes in your will - often funerals occur before probate is completed - but you should at least give it a passing thought in advance. Tell your loved ones. If suitable, include it in your will.Finding the right legal professional

Your final consideration before writing a will is choosing the right legal professional. While you can write your own will, it’s generally not advisable – in the legal world, even a misplaced comma can end up causing issues, so it’s best to call upon the services of a professional.Solicitors and will writers can guide you through the process, dotting the i’s and crossing the t’s. However, many people don’t know quite how to find the right one – one that’s trusted, professional, and intimately understands the will-writing process. After all, searching Google or flicking through the Yellow Pages will only get you so far.

We can help you find a solicitor or will-writer near you expertly tailored to your needs.